Who is TAG?

Our Vision: To build a dynamic national brand recognized for providing high-value insurance and financial products and services to our agents and their clients. To continually exceed every expectation by engaging the talent and passion of people who believe there is always a better way. To offer long-term, financially-rewarding opportunities to our agents, field managers and employees.

A Timeline of Growth

1988

The Beginning

From his garage with a newly-minted insurance license, Ed Shackelford launches Piedmont Brokerage. Product focus is group benefits and Section 125 plans.

1991

Final Expense

1991 to 2003

Company transitions to primarily final expense sales, becoming one of the largest FE sellers in the United States.

2004

Medicare Advantage

2004 to 2007

Shortly after renaming the company The Assurance Group, TAG is awarded an exclusive agreement to sell United Healthcare Medicare Advantage Plans. Arrangement results in sales of $2 Billion.

2008

Senior Products

2008 to 2011

Company diversifies into a full-line brokerage focusing on senior products for America’s middle market. TAG becomes one of the nation’s largest producers of individual major medical plans.

2012

Career Agency

2012 to Current

TAG creates career agency channel. Opens three initial regional sales offices in Charleston SC, Columbia SC and Raleigh NC.

2020

Record Growth

Today

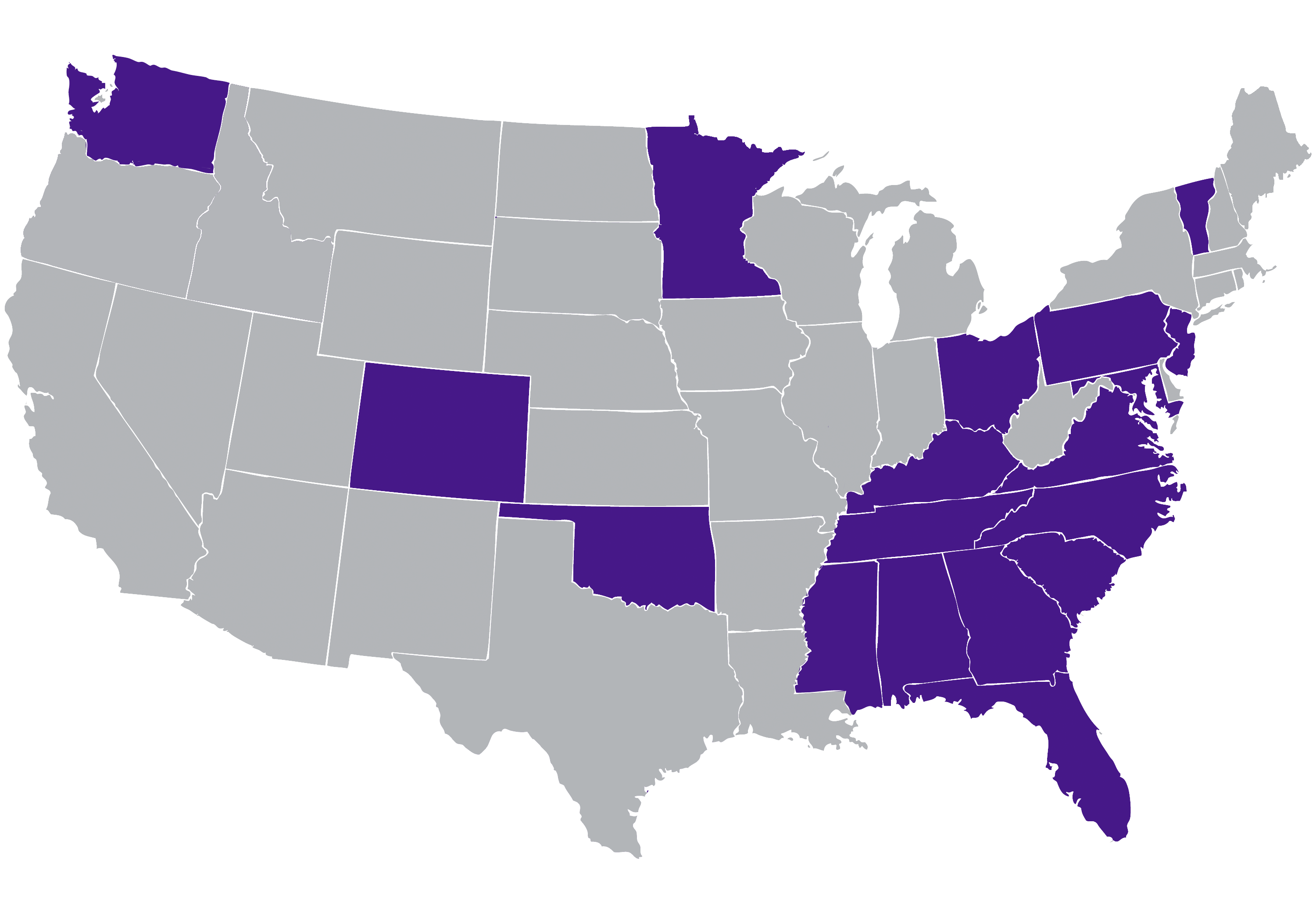

Growing at an unprecedented rate of 40% year over year since inception, TAG’s career channel operates in 25 states from more than 31 regional sales offices.

Core Principles

At TAG, we incorporate our values and team characteristics into six fundamental principles. They continue to influence all of our behaviors and decisions, as we effectively move our organization forward.

Integrity

We will always be consistent in our actions, values, methods, principles, expectations, and outcomes.

Respect

We will always give due respect to others in order to foster an environment of teamwork, growth, and personal development.

Appreciation

We will always be grateful, humble, and gracious toward those people who allow us the opportunity for personal, professional and financial growth.

Ownership

We will always take ownership in, and responsibility for, the success of our co-workers, our agents and our company.

Excellence

We will consistently strive for perfection knowing that if we only achieve excellence, it will have been a very worthwhile journey.

Compliance

We will obey any and all laws and regulations governing our industry for the express purpose of guaranteeing the protection of our clients, our agents and our company.

TAG Leadership Team

Our executive management group guides and directs agents and staff with clarity and transparency. This high-performance team brings a surplus of knowledge, experience and a dedicated commitment to the betterment of all areas of the organization.

Doug A. Bunting

Regional Vice President

Mark L. Carter

Chief Financial Officer

Robert G. Casey

Sr. VP, Medicare & Compliance

John A. Davis

Director, Ordinary Life

Jennifer M. Dennis

Director, Commissions

James L. Dodd

Regional Vice President

Christopher C. Finan

Chief Operations Officer

J. Scott Glanton

Senior Vice President, Sales

Steven H. Jarvis

Vice President, Marketing

W. Curt Klein

Chief Marketing Officer

Sean K. McGee

Regional Vice President

Evan C. Monahan

Director, Training

H. Vann Owens Jr.

Director, Information Technology

Kevin M. Poznek

Vice President, Leadership Development

Edward L. Shackelford

Founder & CEO

Amy N. Smith

Vice President, Operations

Isaiah Smith, II

Senior Vice President, Annuities

Duane Vestal

Senior Vice President

Christopher L. Weaver

Senior Vice President, Sales

Office Locations

An All-In Family

When you join TAG, you become a member of our family. Many of our new family members have gone “All In” and brought their own families along for the ride.

Edward L. Shackelford

Founder & CEO

Never able to contain his entrepreneurial spirit and his dreams of growing a company, Ed left the textile industry in 1988 to begin building the foundation for what would eventually become The Assurance Group. Ed is recognized throughout the industry and among his peers as a trendsetter in the areas of employee benefits, final expense distribution and Medicare Advantage sales. Actively engaged in the day-to-day management of the company, Ed continually brings forth fresh and innovative ideas that fuel TAG’s explosive growth year after year. Ed and his wife Beverly have twin daughters, Brooke and Brittany, and two grandsons.

Video: Getting to Know Ed Shackelford

Duration: 47 Minutes 37 Seconds

Christopher C. Finan

Chief Operations Officer

After serving as TAG's long-time legal council, Christopher officially joined TAG in 2023 as Chief Operations Officer. Chris works tirelessly to increase efficiencies and improve processes to benefit TAG's agents.

W. Curt Klein

Chief Marketing Officer

Curt joined TAG in 2007 and is responsible for sales across both the career and brokerage channels in addition to management and oversight of TAG’s corporate marketing initiatives and brand development. With 29 years of industry experience, 20 of those in senior-level positions at insurance carriers, Curt has developed expertise in sales distribution and management, product development and agent compensation and incentive programs. Curt, a licensed agent, is a graduate of Wheeling Jesuit University with a BA in Human Resource Management. Curt and his wife Sharon have two daughters and four grandchildren.

Doug A. Bunting

Regional Vice President

After a fourteen-year stint with Bankers Life & Casualty where he ultimately served as a Branch Sales Manager and Assistant Regional Director, Doug joined TAG in 2014 as a Regional Sales Director. Doug is a leader on many fronts. His Denver Metro team consistently ranks among the top five offices, he lends his support to TAG’s western-most offices as a Regional Vice President and he spends many days writing business “on his own pen.” Doug and his wife Sherry have been married 41 years and are the parents of four children and eight grandchildren.

James L. Dodd

Regional Vice President

“Jamie” left an advisor role with Prudential to join TAG in 1998 and quickly became one of TAG’s top-producing agents – and stayed at the top until elevated to the position of Regional Vice President in 2019. Over Jamie’s 26 year career at TAG, his teams consistently ranked in the top 5 based on his strong command of multiple product lines. Many of Jamie’s agents went on to become successful managers and sales team leaders as a result of Jamie’s coaching and mentoring abilities. Jamie currently leads his own team based in Thomasville and also supports the growth and development of other regional sales offices. Jamie and his wife Stephanie have been married 27 years and are the parents of Joy, Natalie and Collin.

Mark L. Carter

Chief Financial Officer

Mark joined TAG in 2006 as Chief Financial Officer. Mark’s broad experience in finance, fiscal control systems, audit, taxation and capital deployment strategies ensures TAG maintains the fiscal discipline necessary to continue the company’s rapid growth and expansion. Mark is a graduate of the University of North Carolina at Wilmington with a B.S. in Accounting. Mark is the parent of one daughter, Ashley.

Robert G. Casey, CSA

Senior Vice President, Medicare & Compliance

Rob joined TAG in 1998 as an agent and through hard work and personal commitment now enjoys a position on TAG’s senior leadership team. In addition to oversight and management responsibilities over TAG’s Medicare division, Rob is an expert in insurance law and regulation, making him uniquely qualified to also head up TAG’s compliance department. Rob is a graduate of The University of North Carolina earning a B.A. in Psychology. Rob and his wife Jill are the parents of two daughters and one granddaughter.

John Davis

Director, Ordinary Life

John joined TAG’s administrative team in 2014 and quickly demonstrated a strong acumen for the complexities associated with the presentation and sale of indexed life products. Appointed Director of the Ordinary Life Division in 2018, John works closely with TAG’s agents and field sales leaders to support their sales activities in the areas of training, illustrations and new case processing. John is a graduate of Cornell University earning his B.S. degree in Business. John and his wife Tina have been married for 35 years and are the parents of three children, John, Tyler and Nicholas.

Steven H. Jarvis

Vice President, Marketing

With over a decade of career experience at The Assurance Group, Steven currently serves as Vice President of Marketing. Beginning his career at TAG with a major in Computer Programming, he has embraced a radically different philosophy to traditional marketing. Steven’s fusion of information technology experience and his passion for finding creative marketing solutions has simplified nationwide brand expansion for The Assurance Group. It is his career mandate to utilize technology to enable TAG to continue making a difference in the lives of their agents and each of the individuals insured. Steven and his wife Janielle are the parents of daughter Skylar.

H. Vann Owens Jr.

Director, Information Technology

One of TAG’s first full-time employees, Vann joined TAG in 1993 and quickly introduced the company to the benefits of computer technology. Now, 31 years later, Vann oversees TAG’s robust information technology platform and leads a very talented group of programmers and developers. Vann earned B.S. degrees in both Business Administration and Computer Information Systems from High Point University. Vann has been a long-time Scoutmaster in Archdale, NC (Troop 25) and was awarded the prestigious Silver Beaver Award from the Old North State Council. Active in church activities, Vann and his wife Misty have been married 29 years and are the parents of two children, son Brent and daughter Shay.

Amy N. Smith

Vice President, Operations

Coming to TAG from her position as Marketing Director at Settlers Life Insurance Company, Amy arrived in early 2019 and quickly made significant process improvements to TAG’s back office in the areas of contracting, agent onboarding and reporting. Working closely with TAG’s field sales leaders, Amy and her teams support the sales process through efficient and effective carrier appointment processes, agent on-boarding and agent integration into TAG’s various hierarchies. Amy, a licensed agent, is a graduate of Virginia Intermont College earning her B.S. in Computer Information Management with Minors in Business Management and Graphic Design. Amy and her husband Jeff are the parents of two children, daughters Reagan and Riley.

Isaiah Smith, II

Senior Vice President, Annuities

Since joining TAG in 2013, Isaiah has made a significant impact on annuity sales through enhancements in TAG’s product offerings, training, and agent mentoring as well as improving sales and submission processes. A seasoned financial professional, Isaiah has over 24 years of experience in the annuity, life insurance and mutual fund markets. Isaiah was responsible for growing annuity sales from $350 million to more than $1.4 billion over a nine year period in his previous position. Isaiah, a licensed agent who also holds his Series 65 license, is a graduate of The University of North Carolina at Charlotte earning a BSBA in Marketing. He and his wife Nicki are the parents of four children.

Duane Vestal

Senior Vice President

Duane joined TAG early in the company’s evolution as an independent agent in 1988 after Ed Shackelford recruited him away from a short stint in banking. Doing business then as Piedmont Brokerage (TAG’s predecessor), Duane and Ed knocked on doors of local employers to offer supplemental health insurance products. As the client base began to grow, so did the product line, and with Duane’s help, the company established a firm foundation for future growth. During Duane’s 36-year affiliation with TAG, he has held various senior-level positions. Duane now focuses his many talents on the recruiting and development of both agents and managers at TAG. Duane and his wife Lori are the parents of daughter Olivia.

Christopher L. Weaver

Senior Vice President, Sales

A recognized expert in the development and distribution of supplemental health products, Chris joined TAG early in 2014. For nearly 39 years, Chris served in senior positions with Capitol American Life, Conseco and PMA-USA. In 2012, Chris founded Queen Street America, a national insurance marketing company focused on the sale of cancer plans. Chris’ role at TAG is to recruit talented sales leaders in order to support the continued growth of both the career and brokerage channels. In addition, Chris oversees TAG’s seminar selling platform, TAG Retirement Seminars (TRS). Chris is a graduate of The University of Evansville and has two daughters. Chris and his wife Amy reside in Stowe, VT.

Kevin M. Poznek

Senior Vice President, Distribution Development

Recruited to TAG as a Regional Sales Director in 2017, Kevin successfully migrated his entire agent downline to TAG from Poznek Insurance Agency. After a little more than a year of record-setting sales, Kevin was convinced to join TAG’s senior team and is now responsible for leading TAG’s corporate recruiting initiatives. Kevin and his wife Catherine are the parents of three children, daughter Ashlyn and sons Kevin and Ethan.

Evan C. Monahan

Director, Training

Evan joined TAG in 2018 after leaving Settlers Life Insurance Company where he held the position of Agent Performance Manager. Responsible for developing TAG’s training programs and initiatives, Evan has developed comprehensive programs to better position agents for sales success utilizing TAG’s broad product portfolio and diverse support systems. Evan earned his B.S. degree in Business Administration from King University in 2016. Evan and his wife Brooke have been married 23 years and are the parents of two children, Payton and Aiden.

Jennifer M. Dennis

Director, Commissions

Jennifer joined TAG in 2010 and progressively worked her way up through various administrative positions to become the leader of TAG’s commission accounting department. Jennifer’s talented commissions team processes tens of thousands of transactions per month, making certain that commissions, overrides and renewals are paid to TAG’s agents both timely and accurately. Jennifer works closely with TAG’s IT department to ensure that TAG’s automated payment processes meet her very high standards. Jennifer earned her B.S. degree in Accounting from High Point University. Jennifer and her husband Jason have been married 29 years and are the parents of two children, daughter Macy and son Gavin.

J. Scott Glanton

Senior Vice President, Sales

Bringing 27 years of experience and a long history of industry success, Scott joined TAG in early 2020. Prior to joining TAG, Scott helped lead OneLife America to annual premium sales approaching $100,000,000 as their Chief Sales Officer. Scott’s tenacious support of agents and managers over the years has had a profound impact on many individuals in the industry. Scott is a graduate of Augusta College, earning a B.S. in Mathematics. While at Augusta, Scott was a three- year starter on their baseball team. Scott and his wife Erin have been married 24 years and are the parents of three children, Ian, John Luke and Isabella.

Sean K. McGee

Regional Vice President

After a very successful career as a sales leader with Jackson National Life and ING, Sean joined TAG as a Regional Sales Director in 2013. Sean and his Greenville, SC team are perennial award winners taking #1 office honors at TAG in both 2018 and 2019, in addition to many monthly and quarterly #1 team and product category awards along the way. Sean builds leaders as evidenced by the frequent awards garnered by his management team. Sean is a graduate of The University of South Carolina where he earned his B.S. degree. Sean and his wife Jan have been married 28 years and are the parents of daughter Anna.

TAG's History

Growing up in a family that worked in the textile industry, and in central North Carolina, an area known around the world for its textile plants, Ed Shackelford was destined to spend his working life in the mill.

Well, you would think so.

Ed took his first job in a textile plant as a “fixer” while still a junior in high school. He worked second shift – 3:00 p.m. to 11:00 p.m. Ed’s grandfather, Ray Stafford, happened to be the “head fixer” at the textile plant and would surely teach his young grandson all of the tricks required to keep the loud and dangerous machines running. Ed would learn to fix machines – machines that knitted socks.

Grandpa Ray ultimately retired at the ripe young age of 86, and for those of you that may know Ed, it now becomes clear that a strong work ethic certainly runs in the family. After graduating from high school, and not content with the money he was making at his full-time second shift job at the textile plant, Ed took a third shift job at another plant and for the next six years worked eighteen hours a day, six days a week.

Unable to “scratch the itch” that was driving him to want more out of life, Ed decided to take the North Carolina insurance exam. He passed, but being a bit unsure of himself and how he would fare at sales, he quit his second shift job to begin selling insurance – but kept his third shift job just in case.

The precursor of The Assurance Group was born – Piedmont Brokerage. And like most young entrepreneurs who have a dream, he headed straight for his garage to setup his first office. The year was 1988.

And like most young entrepreneurs who have a dream, he headed straight for his garage to setup his first office. The year was 1988.

From 1988 until 1995, Piedmont Brokerage, with Ed at the helm, became experts in the employee benefits arena and grew to become arguably the largest employee benefits provider in the Southeast. Piedmont Brokerage would also become recognized during this same period as the largest seller of voluntary dental plans in the United States.

Back up to 1993. The Clinton administration had officially proposed the “Health Security Act” which was the start of a discussion on reforming the nation’s healthcare system. Determined not to let Bill and Hillary get in the way of his growing company, and uncertain of the future surrounding employee benefits, Ed Shackelford switched gears and formed Piedmont Brokerage’s life division. Life insurance, he surmised, was out from under the prying eyes of the federal government. By early 1996, Piedmont Brokerage had shifted its focus to selling final expense. And sell it did!

In 1999, with a national agent distribution in place, Piedmont Brokerage, the eleven year old dream of a former “fixer”, became The Assurance Group - “TAG” was born.

One other important event took place during this period. In 1999, with a national agent distribution in place, Piedmont Brokerage, the eleven year old dream of a former “fixer”, became The Assurance Group – “TAG” was born.

In 2003, Congress passed the “Medicare Modernization Act”. Part of that bill took a little known coverage plan and renamed it “Medicare Advantage”. TAG’s next growth phase was about to begin.

In 2004, United Healthcare, a provider of the new Medicare Advantage plans, recognized TAG’s national agent distribution network and approached Ed to determine if there was any interest in having TAG’s ever-growing agent base sell this new “zero premium” Medicare product. Humana, another provider of the new plan also saw TAG’s potential and knocked on TAG’s door.

Over the next three years, TAG agents enrolled over 750,000 Medicare Advantage clients representing nearly $2 Billion in revenue to TAG’s carrier partners. TAG’s reputation as a national insurance marketing organization was now solidified.

By 2008 changes in CMS regulations governing Medicare Advantage plans, such as benefit changes, shortened selling seasons. A compression of agent commissions meant it was time once again for TAG to refocus its strategy and diversify the portfolio.

Still a prolific seller of Medicare Advantage plans to this day, TAG’s diversification plans beginning in 2008 included increasing final expense sales which slowed due to the advent and growth of Medicare Advantage, an amplified focus on the sale of Medicare Supplement plans, creation of an annuity division and an entry into the individual Major Medical market. It became yet another successful corporate realignment that carried TAG into 2012.

Early in 2012, TAG’s leadership, buoyed by Ed’s desire and vision to create the best (not necessarily the largest) career agent platform in the country, began building what today has become TAG’s Career Division.

Through effective recruiting and timely acquisitions, TAG’s Career Division has since experienced hyper-growth. With thirty physical office locations in seventeen states, TAG’s career agent system focuses on serving clients with a needs-based sales approach.

Careful and thorough client reviews, completed by TAG’s well-trained career agents at the point of sale, not only identifies the important coverage needs of our clients but allows TAG agents access to a broad portfolio of products. These include Medicare Supplement, Medicare Advantage, life (both final expense and traditional), annuities, long term care, under-age health and supplemental plans.

Today, TAG’s distribution model consists not only of our career agency system, but also by nearly 5,000 brokerage agent relationships throughout the United States.

TAG’s business model can best be described this way – we integrate world-class people with world-class products and provide them with world-class support.

TAG’s business model can best be described this way - we integrate world-class people with world-class products and provide them with world-class support.

TAG’s “agent-centric” philosophy guides us to an understanding that our agents deserve only the best. The best service from home office personnel. The best products. The best training. The best compensation, reward and performance recognition programs in the industry.

Since 1988, TAG has evolved from a dream started in Ed Shackelford’s garage into a nationally recognized leader in the marketing and sale of insurance products.

Since 1988, TAG has evolved from a dream started in Ed Shackelford’s garage into a nationally recognized leader in the marketing and sale of insurance products.

Today, TAG has nearly 150 full-time employees, 30 physical office locations, 500 active career agents and just shy of 5,000 brokerage agents.

TAG’s past growth and success is a result of putting people first. Future growth and success is ensured because TAG will continue to be guided by a value system that defines people as our most treasured resource.