Homepage

Life

Final Expense / Ordinary Life

Offer your clients peace of mind with coverage for end-of-life costs and easing the financial burden on their families.

Health

Medicare Plan Options / Supplemental Health

Help your clients navigate the complexities of Medicare with our tailored plans that ensure comprehensive coverage and affordability.

Wealth

Financial Services / Annuities

Secure your clients’ financial future with our flexible annuity options and financial services designed to provide stable income streams and peace of mind.

Our Agents

Hear directly from our agents — and let TAG be the difference-maker for you.

With new agents who recently passed their licensing exam and experienced agents who have accomplished 20+ years in the field, our TAG team interacts and builds each other up every day. Every one of us works within the supportive framework of our organization.

Our Career Advantages

Our commissions and renewals

The Commission program at TAG builds at each agent level, with an increase in compensation based on agent and/or team performance. Policy renewal payments are a continuous source of income for agents. And TAG can provide an advance on agent commissions. Detailed information is included as part of our agent onboarding program.

Our agents have a path to advancement

The Assurance Group provides opportunities for advancement based on an agent’s paid number of policies and annualized paid premiums. The performance hierarchy includes both W2 with company-paid benefits and 1099 positions. Your professional growth and financial achievements are recognized and rewarded at TAG.

Our training opportunities abound at The Assurance Group!

- Dedicated subject matter experts in Medicare Plan Options, Annuities, Final Expense, Ordinary Life and Recruiting

- Live video sessions providing real-time updates and information on topics that matter to you.

- Our exclusive agent-only website includes on-demand training, recruiting tips, division-specific information, marketing content and more.

Our Story

Passionate. Resilient. Innovative. That’s Ed Shackelford, founder and CEO of The Assurance Group – the fastest-growing insurance marketing organization in the United States. Partner with us as a team builder or as a personal producer and see for yourself how we’re growing at a rate of 40 percent year over year.

Through his diligent attention to the needs of the Senior Market, the company has expanded into a well-established and respected organization with agents across the country and more than 30 regional offices.

Our Parent Company

In October 2020, The Assurance Group proudly became a partner with Integrity.

Thanks to that partnership, TAG continues to grow at an industry-leading pace with access to Integrity-exclusive resources and technology.

Especially unique to the insurance business, TAG offers W2 opportunities for sales roles which enjoy participation in Integrity’s Employee Ownership Plan as well as additional employee benefits like 401(k), health benefits, and more.

Our Core Principles

At TAG, we incorporate our values and team characteristics into six fundamental principles. They continue to influence all of our behaviors and decisions, as we effectively move our organization forward.

Integrity

We will always be consistent in our actions, values, methods, principles, expectations, and outcomes.

Respect

We will always give due respect to others in order to foster an environment of teamwork, growth, and personal development.

Appreciation

We will always be grateful, humble, and gracious toward those people who allow us the opportunity for personal, professional and financial growth.

Ownership

We will always take ownership in, and responsibility for, the success of our co-workers, our agents and our company.

Excellence

We will consistently strive for perfection knowing that if we only achieve excellence, it will have been a very worthwhile journey.

Compliance

We will obey any and all laws and regulations governing our industry for the express purpose of guaranteeing the protection of our clients, our agents and our company.

Our Technology

TAG’s proprietary agency management platform provides agents and managers the tools necessary to successfully manage their business.

Join an organization that matches your commitment to personal success.

Electronic Contracting

Appoint quickly and easily with carriers through TAG’s e-signature contracting process.

Commission Statements

Commissions and renewals are available in one consolidated statement.

Reporting & Analytics

Use our robust reporting to manage client data, track sales trends and agent productivity.

Pending Case Requirements

No need to go to multiple carrier websites to manage and track your pending cases.

Lead Delivery & Management

Receive and manage leads and call lists directly from the website.

Our Retirement Seminars

Our agents educate seniors every day!

Share your knowledge of Medicare, Final Expense, Annuities, Life Insurance, Long Term Care and Critical Illness coverage with the seniors who need your help. We provide agent training in multiple product lines and help you organize and practice your presentation with TAG materials and resources each step of the way. As a result, TAG Retirement Seminars contribute to your sales production as a consistent and continual source of prospects and referrals.

Our Appointment Setting Program

Make every week a productive week by utilizing our professional in-house call center. TAG appointment setters deliver a full calendar of appointments so you can focus on what you do best – getting out in the field and working with clients.

rewards

and recognition

At TAG, we continuously applaud and celebrate the hard work of our agents.

Individual & Team Awards

Earn Monthly and Annual awards at all career levels as you work toward personal objectives and team goals.

Chairman's Club

Reach the top level of sales excellence and leadership in this elite group with a customized ring and diamonds added for qualifying years.

Honor Society

Collect all the accolades each year for achieving specific personal production standards (Diamond, Ruby and Emerald levels).

Sales Incentive Destinations

Our Exclusive Lead System

TAG combines years of experience with superior technology as well as both art and science to deliver the best lead program in the industry.

Our History

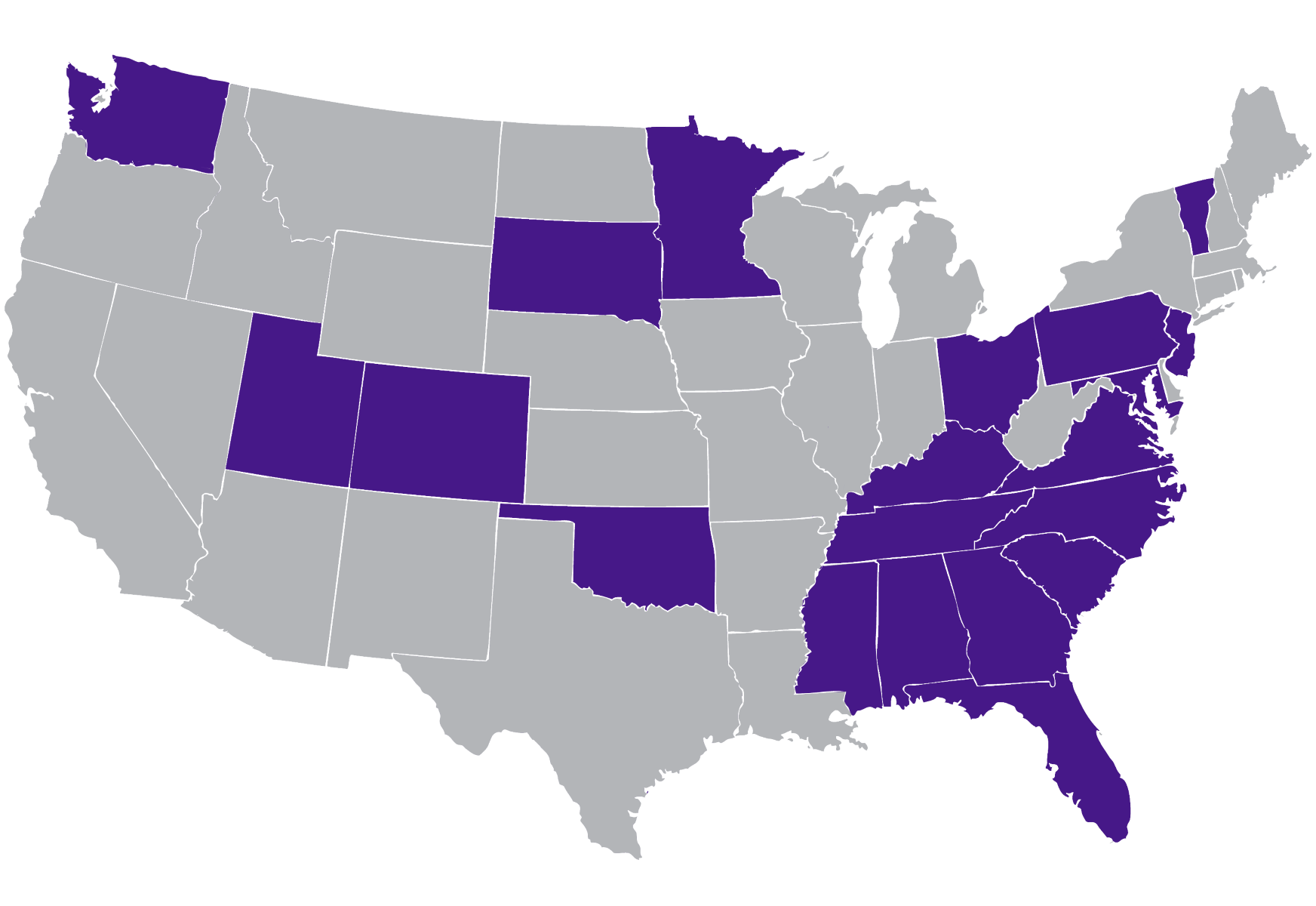

Our Office Locations

TAG maintains regional offices across the country, with products available in all fifty states.

Our Carrier Partners

Your Turn

The “agent-centric” culture, cutting-edge technology, broad product portfolio and best-in-class agent support platform make TAG the right choice for agents across the country.

Get In Touch

TAG’s Rewards and Recognition

TAG Retirement Seminars

TAG's History

Growing up in a family that worked in the textile industry, and in central North Carolina, an area known around the world for its textile plants, Ed Shackelford was destined to spend his working life in the mill.

Well, you would think so.

Ed took his first job in a textile plant as a “fixer” while still a junior in high school. He worked second shift – 3:00 p.m. to 11:00 p.m. Ed’s grandfather, Ray Stafford, happened to be the “head fixer” at the textile plant and would surely teach his young grandson all of the tricks required to keep the loud and dangerous machines running. Ed would learn to fix machines – machines that knitted socks.

Grandpa Ray ultimately retired at the ripe young age of 86, and for those of you that may know Ed, it now becomes clear that a strong work ethic certainly runs in the family. After graduating from high school, and not content with the money he was making at his full-time second shift job at the textile plant, Ed took a third shift job at another plant and for the next six years worked eighteen hours a day, six days a week.

Unable to “scratch the itch” that was driving him to want more out of life, Ed decided to take the North Carolina insurance exam. He passed, but being a bit unsure of himself and how he would fare at sales, he quit his second shift job to begin selling insurance – but kept his third shift job just in case.

The precursor of The Assurance Group was born – Piedmont Brokerage. And like most young entrepreneurs who have a dream, he headed straight for his garage to setup his first office. The year was 1988.

And like most young entrepreneurs who have a dream, he headed straight for his garage to setup his first office. The year was 1988.

From 1988 until 1995, Piedmont Brokerage, with Ed at the helm, became experts in the employee benefits arena and grew to become arguably the largest employee benefits provider in the Southeast. Piedmont Brokerage would also become recognized during this same period as the largest seller of voluntary dental plans in the United States.

Back up to 1993. The Clinton administration had officially proposed the “Health Security Act” which was the start of a discussion on reforming the nation’s healthcare system. Determined not to let Bill and Hillary get in the way of his growing company, and uncertain of the future surrounding employee benefits, Ed Shackelford switched gears and formed Piedmont Brokerage’s life division. Life insurance, he surmised, was out from under the prying eyes of the federal government. By early 1996, Piedmont Brokerage had shifted its focus to selling final expense. And sell it did!

In 1999, with a national agent distribution in place, Piedmont Brokerage, the eleven year old dream of a former “fixer”, became The Assurance Group - “TAG” was born.

One other important event took place during this period. In 1999, with a national agent distribution in place, Piedmont Brokerage, the eleven year old dream of a former “fixer”, became The Assurance Group – “TAG” was born.

In 2003, Congress passed the “Medicare Modernization Act”. Part of that bill took a little known coverage plan and renamed it “Medicare Advantage”. TAG’s next growth phase was about to begin.

In 2004, United Healthcare, a provider of the new Medicare Advantage plans, recognized TAG’s national agent distribution network and approached Ed to determine if there was any interest in having TAG’s ever-growing agent base sell this new “zero premium” Medicare product. Humana, another provider of the new plan also saw TAG’s potential and knocked on TAG’s door.

Over the next three years, TAG agents enrolled over 750,000 Medicare Advantage clients representing nearly $2 Billion in revenue to TAG’s carrier partners. TAG’s reputation as a national insurance marketing organization was now solidified.

By 2008 changes in CMS regulations governing Medicare Advantage plans, such as benefit changes, shortened selling seasons. A compression of agent commissions meant it was time once again for TAG to refocus its strategy and diversify the portfolio.

Still a prolific seller of Medicare Advantage plans to this day, TAG’s diversification plans beginning in 2008 included increasing final expense sales which slowed due to the advent and growth of Medicare Advantage, an amplified focus on the sale of Medicare Supplement plans, creation of an annuity division and an entry into the individual Major Medical market. It became yet another successful corporate realignment that carried TAG into 2012.

Early in 2012, TAG’s leadership, buoyed by Ed’s desire and vision to create the best (not necessarily the largest) career agent platform in the country, began building what today has become TAG’s Career Division.

Through effective recruiting and timely acquisitions, TAG’s Career Division has since experienced hyper-growth. With thirty physical office locations in seventeen states, TAG’s career agent system focuses on serving clients with a needs-based sales approach.

Careful and thorough client reviews, completed by TAG’s well-trained career agents at the point of sale, not only identifies the important coverage needs of our clients but allows TAG agents access to a broad portfolio of products. These include Medicare Supplement, Medicare Advantage, life (both final expense and traditional), annuities, long term care, under-age health and supplemental plans.

Today, TAG’s distribution model consists not only of our career agency system, but also by nearly 5,000 brokerage agent relationships throughout the United States.

TAG’s business model can best be described this way – we integrate world-class people with world-class products and provide them with world-class support.

TAG’s business model can best be described this way - we integrate world-class people with world-class products and provide them with world-class support.

TAG’s “agent-centric” philosophy guides us to an understanding that our agents deserve only the best. The best service from home office personnel. The best products. The best training. The best compensation, reward and performance recognition programs in the industry.

Since 1988, TAG has evolved from a dream started in Ed Shackelford’s garage into a nationally recognized leader in the marketing and sale of insurance products.

Since 1988, TAG has evolved from a dream started in Ed Shackelford’s garage into a nationally recognized leader in the marketing and sale of insurance products.

Today, TAG has nearly 150 full-time employees, 30 physical office locations, 500 active career agents and just shy of 5,000 brokerage agents.

TAG’s past growth and success is a result of putting people first. Future growth and success is ensured because TAG will continue to be guided by a value system that defines people as our most treasured resource.

Our Exclusive Lead System

- TAG offers agents leads through our business partnership with Leads2Success. Our new leads are exclusive to our agents and are NEVER re-sold.

- Turn-around time is quick. Leads2Success delivers the information you need in as little as five minutes, through our proprietary e-delivery system, including a spreadsheet and a PDF image of each lead.

- TAG agents have people to see every day through our No-Cost Exclusive Lead Program. We are in the business of marketing and selling insurance products. Leads ARE NOT a profit center at TAG.

-

Agents can supplement prospecting activity with call lists that focus on demographics, such as age, birthday or income. In addition, Recycled leads (leads reconciled as “not sold”) are returned to a recycled inventory and are free of charge to TAG’s career agents.